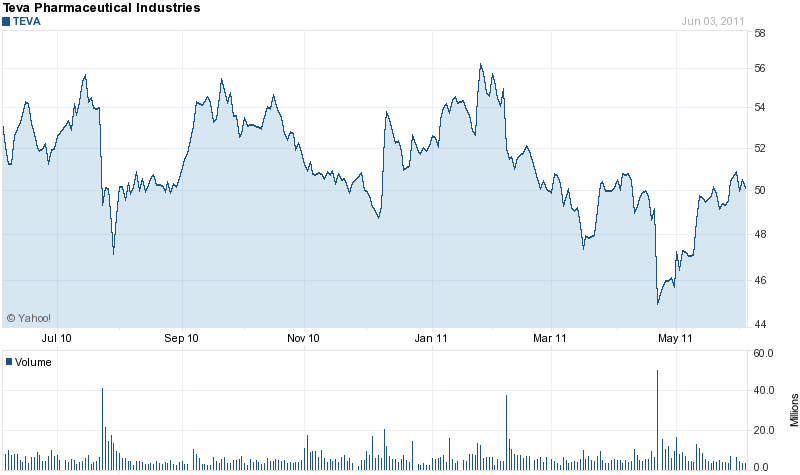

Teva Pharmaceutical, Ltd., traded on the NASDAQ and Tel Aviv Stock Exchanges, has bounced off its two-year low of $45 a share, and is currently trading 11% higher. This rise is likely due to its recent acquisition of a specialty, branded drug-maker Cephalon for $6.8 billion in early May. It is also attributed to the FDA approval of the company's generic version of a treatment for HIV in late May.

Teva's defensive call options provide a way to make 25% a year even if the stock price moves sideways going forward. Contact us for more information on this strategy.

About Teva's Acquisition

Teva Pharmaceutical Industries Ltd. and biopharmaceutical company Cephalon announced that their boards of directors have unanimously approved an agreement by which Teva will acquire all of Cephalon's shares for $81.50 per share in cash, or a total value of $6.8 billion. This was a 5% premium on Cephalon's closing share price on NASDAQ the day before. The transaction is not conditional on financing and is expected to be completed in the third quarter of 2011. Cephalon had revenue of $2.76 billion and net profit of $657 million in 2010 mainly from brand drugs treating cancer, central nervous system disorders and pain. The company has a market capitalization of $5.8 billion. Teva stock can be purchased with an Israeli investment account or on Wall Street.

Teva Pharmaceutical Industries Ltd. and biopharmaceutical company Cephalon announced that their boards of directors have unanimously approved an agreement by which Teva will acquire all of Cephalon's shares for $81.50 per share in cash, or a total value of $6.8 billion. This was a 5% premium on Cephalon's closing share price on NASDAQ the day before. The transaction is not conditional on financing and is expected to be completed in the third quarter of 2011. Cephalon had revenue of $2.76 billion and net profit of $657 million in 2010 mainly from brand drugs treating cancer, central nervous system disorders and pain. The company has a market capitalization of $5.8 billion. Teva stock can be purchased with an Israeli investment account or on Wall Street.

FDA Approves MCS Thrombosis Treatment

Israeli biomedical company MCS Medical Compression Systems' stock has gained 92% in the past two years. The company develops the only device on the market that combines simultaneous diagnostics with treatment during preventative care. Marketing will begin in 2012. MSC has obtained U.S. Food and Drug Administration (FDA) marketing approval for its ActiveCare + DT non-invasive device for treating deep vein thrombosis and preventing embolisms. The company's stock is traded on the Tel Aviv Stock Exchange.

Source: Globes

Comments 1

interested in more information on Israel’s stocks including TEVA

Thanks