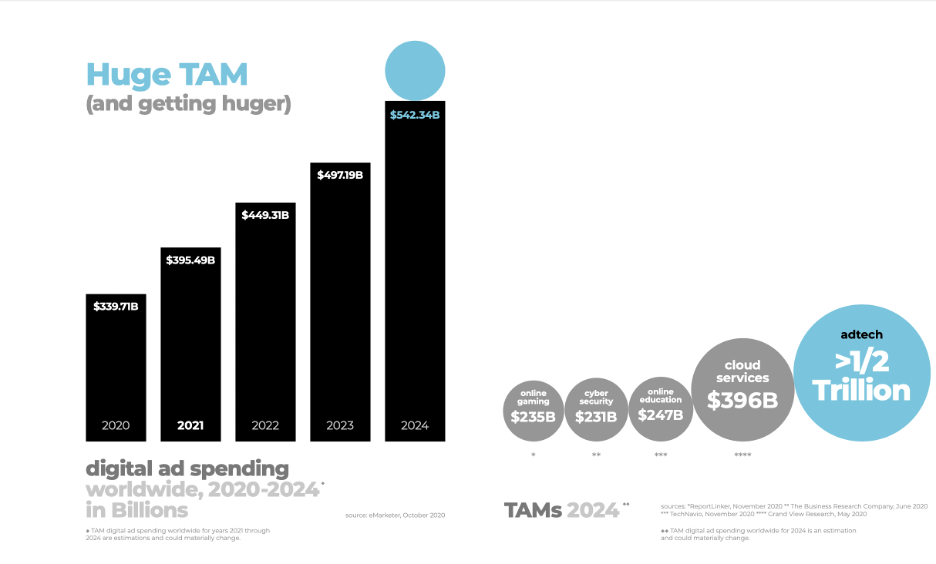

Today, we highlight Perion Networks, a global technology innovator in the digital advertising ecosystem. This Israeli firm, founded in 1999, provide companies with an opportunity to unlock online growth opportunities. The organization operates across three main segments of digital advertising space – social media, ad search, and Connected TV/display/video. The Total Addressable Market (TAM) is believed to be worth $300 Billion (and over $500 Billion by 2024).

Total Addressable Market for advertising

A New Standard Delivered Using AI

Perion Network delivers Artificial Intelligence (AI)-driven advertising solutions to advertisers and publishers. It further develops digital advertising solutions to capture consumer attention and increase engagement. In addition, Perion also provides online advertising and mobile applications.

The steady growth of social advertising was accelerated by COVID-19 and the boom in e-commerce. Perion’s social marketing platform offers a dashboard for marketers that makes it easy to manage and optimize advertising campaigns in real-time. Designed with social media in mind such as, Twitter, Instagram, Facebook, Snap, TikTok, Google, Linkedin and Pinterest on a cross-network basis. This leads to happy advertising clients with improved ROI. Their high-profile clientele includes Pepsi, RedBull, Louis Vuitton, Mercedes-Benz, Delta, Samsung, BMW, Toyota and Dell. They also provide advertising solutions for big media companies like Disney, ABC, CBS, A&E, BBC, NBC, and Fox News.

Perion further strengthens its technology position by evolving an integrated offering, branded as “Capture and Convince.” The new technology represents a significant industry advance in the user funnel. With its new user loop, it employs AI and machine- learning techniques. The result is optimized advertising and content for brand-safe sites which has been shown to engage new users for up to six minutes. Engaging users online this long generates significant revenue-per-session for the advertiser while uniquely satisfying the needs of the user.

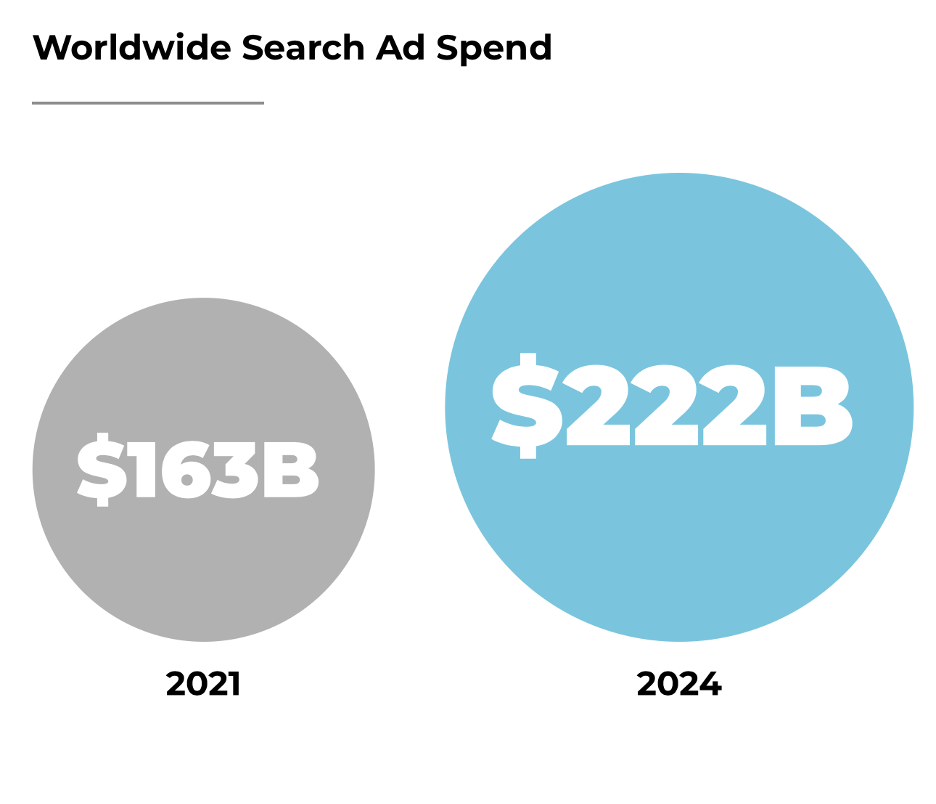

Perion also provides publishers with increased web traffic, higher engagement, and increase in revenue-per-session. Their digital advertising search monetization solution captures consumers at the moment of highest intent to purchase. The firm has a longstanding relationship with Microsoft Bing and other leading search and content partners across 34 countries. That is how it implements its monetization solution more effectively than conventional search solutions.

Ad spend on digital media

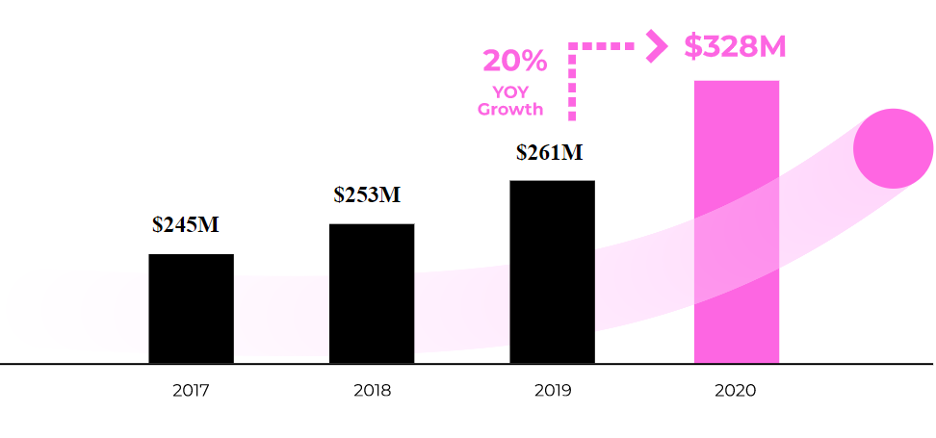

Perion Sees Surprising Growth During COVID-19

With COVID-19 shutting down economies around the globe, Perion (and other companies in the sector) emerged as benefactors of the changed business environment. Even as the pandemic sent shockwaves through the market, the company has managed to deliver robust growth, with overall annual revenue Year-over-Year growing by 20%. Display and social advertising revenues are growing 159% Year-over-Year despite COVID-19.

Growth of Perion Revenue

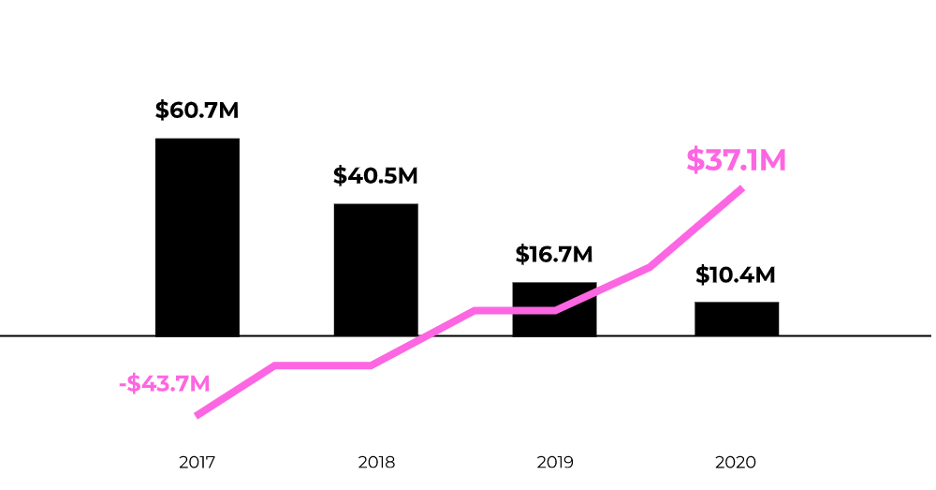

The strength of the balance sheet is manifested in declining debt levels. In 2017, the company's debt stood at $60.7M. Last year, that amount plunged to only $10.4M. Over the same period, cash position improved from -$47M to +$37M, a difference of $84M in just 4 years.

This dramatic shift enabled Perion to make strategic acquisitions and enabled significant new investments in Research & Development.

Perion debt-to-cash ratio

Benefit From Wise Money Israel's Research Team

Wise Money Israel has held this Israeli technology stock as part of our client managed portfolios, and in the past year, the share price rose 173%. Also, our firm purchased and strategically took profits during the past 12 months, increasing even further our client’s gains on this stock.

This example demonstrates the Wise Money Israel process: investing in Israeli companies low in debt and high in revenue that demonstrate growth in its top line, as well as earning growth on the bottom line.

If you would like to see this kind of growth for your portfolio, please contact us about investing in Israel.

To invite a speaker click here