Why invest in Israel? Foreign investors are putting billions of dollars in Israel. Find out why investing in Israel isn't just for the mega rich or sophisticated investor. In this article, we discuss why you should consider investing some of your money in Israel as part of your investment strategy.

This is part two of a four-part series on good reasons to invest in Israel:

- our article

- Why foreign investors like the Israeli financial market (below)

- our article

- our article

Why foreign investors like the Israeli financial market

- Israel's largest publicly traded company's stock prices (Tel Aviv 25 index) soared 62% in the past five years, compared with the negative (-11%) performance of the S&P 500 (the standard benchmark for U.S. stock performance) during the same period.

- Foreigners are investing in Israel because they are seeking better performance and a strong market. Foreign investment reached an impressive $9.3 billion in 2009 (4.8% of GDP). Funds also entered Israel through the Tel Aviv Stock Exchange. The Tel Aviv 25 index, for example, showed an impressive 71% return during 2009 while the S&P 500 returned 28%. Owning Israeli stocks or bonds on either the Tel Aviv Stock Exchange or Wall Street is a good way to take advantage of this country's strength and economic stability.

- The Israeli shekel has outperformed many world currencies during the recent global crisis. Nowadays, many investors have become wary of the dollar considering all of the money printing that has gone on in the U.S. in the last two years. Investors are also fleeing the euro, trying to gain currency stability in other currencies. With future high inflation in the U.S. almost assured, it would be wise to get exposure to other strong, foreign currencies. One destination investors are placing their money is in Israel and in the Shekel through investing in Israeli stocks and bonds. The Israeli Shekel has gained 20% on the U.S. dollar in the past five years (as of May, 2014).

- Investors are recognizing the strength of the Israeli capital market vs. other global markets. Israel is considered a safe-haven due to its resilient economic performance during the recent economic crisis, relative to other world markets.

- Israel is a place in which Investor Protection reigns supreme: The World Bank, in its annual "Doing Business" survey of 181 countries, ranks Israel fifth, alongside the U.S., Canada, and Ireland, and outranking the United Kingdom in the area of investor protection.

- For years considered an Emerging Market, Israel was recently upgraded by to a Developed Market by MSCI. Designed to represent the investable opportunity set for international investors, the MSCI International Equity Indices are the most widely used global benchmarks in the industry. Hence, Israel joining this select group of 23 other developed countries in the index indicates the international strength of the Israel economy and its stability. This important reclassification opens up investment by large, international funds that only invest in developed nations, which will increase the attractiveness and demand for Israeli stocks (and therefore increase their prices).

- Although it is only 62 years old, Israel is a technology world leader in medical devices and technology, agricultural technology, bio-tech and military technology. Many of these Israeli companies are publicly traded, allowing shareholders to benefit from Israeli innovation.

- Israel is a high-tech powerhouse: The country is a global leader in many high-tech sectors such as electronics, generic pharmaceuticals, biotechnology and aeronautics. Exports of products by the high-tech industry have grown at an annual rate of 8.5% in the last five years. Israel exports close to $20B in high-technology products. Israeli high tech contributes 17% to the business sector GDP and 32% to the export of goods and services.

- U.S. President Obama’s drive for sources of alternative energy, coupled with like messages from global leaders, means Israel's alternate energy high-tech companies stand to gain. Israel remains among the biggest worldwide participants of water and clean tech technologies.

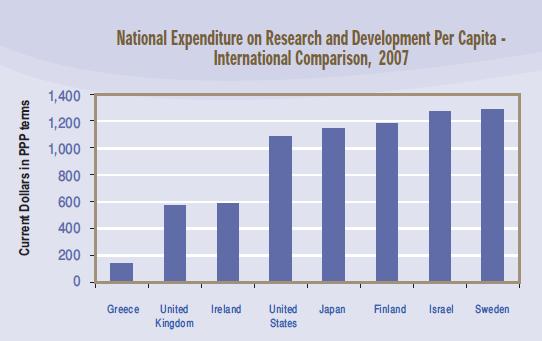

- Israel invests heavily in R&D: The value of investment in research and development as percentage of GDP in Israel is the highest in the world. High R&D spending coupled with a highly skilled and educated workforce spawns hundreds of start-ups producing many successful commercial products. The country has the highest number of scientists and engineers per capita in the world, double that of the U.S. and Japan. Hence, one of the areas where Israel excels compared to other OECD (Organisation for Economic Co-operation and Development) countries is the Information and Communication Technologies (ICT) sector, which forms a considerable portion of exports. Little wonder that after Silicon Valley, Israel has the highest concentration of start-ups anywhere in the world.

- Israel is a world leader in innovation: Israel has the largest number of companies listed on the NASDAQ outside of North America and China. Israel also leads the world in technology start-ups companies per capita, and has more start-ups than any country other than the U.S. This is very significant considering the country’s population (only 1/1000th of the world's population) is relatively small compared to many other countries such as India, China, Brazil, UK, France, etc. Over 130 Israeli companies are listed on Wall Street.

- Israel has attracted the most venture capital investment per capita in the world, 30 times more than Europe. Israel is ranked in the top five Cleantech countries of the world, and operates the world’s largest desalinization plant. Israel leads the world in the number of scientists and technicians in the workforce, 63% more than the U.S. It also has the most physicians and engineers per capita. More Israeli patents are registered in the United States than from Russia, India and China combined (combined population 2.5 billion). It leads the world in patents for medical equipment. Israeli companies invented the drip irrigation system, discovered the world’s most used drug for multiple sclerosis, designed the Pentium NMX Chip technology and the Pentium 4 and Centrium microprocessors and created Instant Messenger (ICQ). Here's a great video about Israel's amazing achievements.

Prominent financial leaders endorse investing in Israel

- Bank of Israel is doing a good job of Quantitative Easing - Ahmet Akarli, VP, New Markets Economics, Global Investment Research Division, Goldman Sachs: "Israel’s economic downturn during the crisis has been much milder than for its peers in the New Markets region, thanks in part to the aggressive and timely policy response of the Bank of Israel (BoI). The economy has already reclaimed output losses and is set to grow steadily in the coming few years. Inflation pressures remain relatively subdued and the likelihood of a large inflation overshoot from targets remains low, given the BoI’s commitment to ensuring price stability. We expect the Bank to continue to unwind its quantitative easing measures this year and bring rates to a more neutral 3 percent level by the end of 2010. We expect further Shekel appreciation as the Bank loosens its grip over the currency, consistent with recovery in the global and domestic economy."

- In a December 2009 report titled “Playing Defense”, Bank of America Merill Lynch recommended Israel as an attractive investment destination and recommended companies, especially in the banking and telecom sectors. According to Merril Lynch, some of the reasons for investing in Israel included the strong currency vs. the U.S. dollar, the resilient economic performance among other emerging markets and the strong leadership performance shown by the Bank of Israel and the Ministry of Finance in handling the economy.

Sources: Central Bureau of Statistics (CBS), Ministry of Finance, Bank of Israel, International Monetary Fund, Vale-Columbia Center on Sustainable International Investment, Government of Israel Economic Mission, Tel Aviv Stock Exchange and others

Next in this series: our article

How can I invest in Israel?

There are many ways to invest in Israel or Israeli companies, from buying Israeli stocks on Wall Street, ETFs or mutual funds, bonds, or investing directly on the Tel Aviv Stock Exchange from an Israeli investment account. You can read more about our article for more details.

Keep checking back on Wise Money Israel (or get email updates) to gain more insight and tips on how to wisely invest in the Israeli capital market.