Why invest in Israel? Here are the top economic reasons people invest their money in the Holy Land. You'll also find out why foreign investors are putting billions of dollars in Israel and what makes its economy so special.

Investing in Israel isn't just for the mega rich or sophisticated investor; this article is about why you should consider linking some of your money with Israel regardless of the amount or your investment experience.

This is part three of a four-part series on good reasons to invest in Israel:

- our article

- our article

- Why Israel's economy is strong (below)

- our article

Why Israel's economy is strong

- Israel's real GDP growth (3.2% for 2010) is higher than that of other developed nations (2.3%), according to the International Monetary Fund (IMF). For 2010-2011, IMF projects a 3.4% growth for Israel, better than that of the United States, Japan, United Kingdom, Canada, France and Germany.

- The IMF predicts Israel's 2010 inflation rate will be relatively low at 2.3%.

- Israel has a relatively low unemployment rate. The IMF projects Israel's unemployment rate to be 7.4% in 2010, compared to the average unemployment rate in developed economies of 8.4%. In comparison the United States 2010 unemployment rate is projected to be 9.4%.

- Israel's current account balance ended 2009 with a surplus of $7.2 billion, 3.7% of total GDP (up 453% from 2008). The United States ended 2009 with a deficit of $418 billion (2.9% of GDP).

- Israel recently became a member of the OECD (Organisation for Economic Co-operation and Development). This prestigious international economic body is a forum of developed countries committed to democracy and the market economy and coordinating domestic and international policies of its members. Israel joins member nations such as the United States, Japan, Canada, France, Australia, United Kingdom and Germany.

- Israel had very low growth in its debt to GDP ratio during 2009. Debt to GDP ratio ended the year at 79.9 percent, only 2.8 percent higher than the year-end percentage for 2008. This achievement can be attributed to the well-planned and disciplined fiscal policy implemented by the government.

- General government consumption accounts for a small portion of the total GDP.

- The Israeli Central Bank recently reported Israel’s M1 money supply dropped 1.1%. This compares well to other countries, including the U.S. and U.K., where printing massive amounts of money among other liquidity strategies caused their money supply to increase by hundreds of percent over the last two plus years. Flooding an economy with money usually leads to high inflation. Israel is not in danger of high inflation.

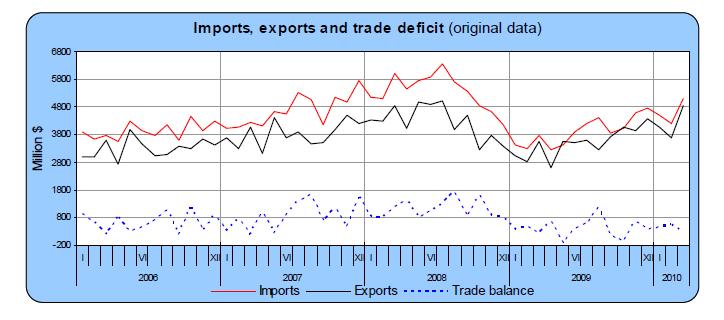

- Israel is a big exporter: because of limited natural resources, in terms of foreign trade Israel imports raw materials such as crude oil, coal, raw diamonds, etc. and exports manufactured goods such as polished diamonds, aircraft parts, pharmaceutical products, chemicals, electronics, etc. This gives the country an advantage since raw materials are usually cheap but manufactured goods offer high profits. For example, in March 2010 manufacturing goods (excluding diamonds) accounted for 80% for all exports.

- Unlike the U.S., which usually runs a large trade deficit because of imports from China, Israel’s trade deficit is very small. The U.S. and Europe are Israel's largest trade partners and also its largest export markets.

Sources: Central Bureau of Statistics (CBS), Ministry of Finance, Bank of Israel, International Monetary Fund, Vale-Columbia Center on Sustainable International Investment, Government of Israel Economic Mission, Tel Aviv Stock Exchange and others

Next in this series: our article

How can I invest in Israel?

There are many ways to invest in Israel or Israeli companies, from buying Israeli stocks on Wall Street, ETFs or mutual funds, bonds, or investing directly on the Tel Aviv Stock Exchange from an Israeli investment account. You can read more about our article for details.

Keep checking back on Wise Money Israel (or get email updates) to gain more insight and tips on how to wisely invest in the Israeli capital market.