JPMorgan Chase, the largest U.S. bank, has sent letters to businesses outlining new policies that can drastically change how you operate. Certain businesses will no longer be able wire funds outside of the borders of the U.S. Have capital controls in the United States begun? Also, business customers with Chase BusinessSelect Checking and Chase BusinessClassic accounts have received letters recently informing them that cash activity (both deposits and withdrawals) will be limited to a $50,000 total per statement cycle from November 17, 2013 onward.

NewsWire writes: "If you were planning on getting your money out of the country, now is the time. If you haven’t withdrawn your cash from the bank, you should have done it yesterday."

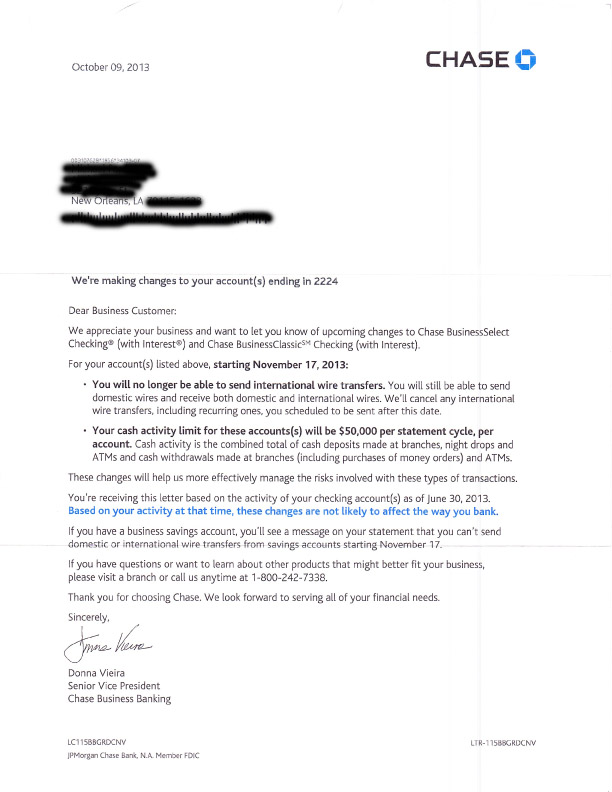

According to sources that received the letter, the letter reads like this:

While on the surface, these changes may appear benign, they represent a fundamental shift in U.S. banking and their effect on commerce.

In order for a business to continue to send international wire transfers, they would have to “qualify” with them for a special type of international bank account and would have to deposit huge amounts of money and pay fees to be able to access those services.

This may represent a step towards capital controls as we saw with the recent Cyprus bail-in.

Some believe that Chase would not be implementing a business killing strategy like this unless it was evident that all other major banks were also planning to follow suit. It now appears that mega banks are leading the way to set the precedent that all the others will follow.

Chase Bank Claims Concern About Capital Controls is an “Overreaction”

While admitting that it is imposing limits on cash transactions and banning international wire transfers for business customers, Chase Bank claims the measures do not represent “capital controls” and instead are merely about “streamlining” and “derisking,” labeling concern about the new measures an “overreaction.”

The bank also says that it is removing the ability of business customers to send international wires because there is no oversight in the form of a “bank representative managing them,” another indication that the outfit has little respect for financial privacy.

Chase also fails to mention in its response that the accounts business customers are being forced to open if they want such restrictions removed require far larger amounts of money to be deposited and also force customers to pay fees for wire services, fueling concerns that the move is about strangling small businesses.

Why Enact Capital Controls?

- Capital controls to prevent money leaving the country as the US dollar continues to devalue. Note that Chase will allow international wire transfers coming in, but not going out of the accounts. Note that they are only concerned about “risks” when the money is being moved out of the account.

- Forcing small businesses to abandon cash and switching everything over to digital currency that can be more easily tracked, traced and controlled.

- Part of the preparatory phase for Cyprus-style bail-ins where the government announces a new “tax” to gouge out a percentage of people’s savings.

The fear is small and medium-sized businesses could be hurt by the restrictions. But the bank says these were typically mass accounts opened on the Internet, with no bank representative managing them, where domestic or international wire transfers could be sent without bank oversight.

The bank says it is "derisking" these accounts by streamlining the number of customer accounts from, say, six accounts with no bank contact or representative to three accounts with a bank rep managing them. Also the bank said some of the accounts customers had signed up for did not have wire transfer services that customers had wanted, or had limited withdrawal services, but that the bank is instead transferring these customers into new accounts that do provide these services.

Chase said it is not exerting new capital controls on customer accounts.

Bank Holiday

Financial experts like Gerald Celente agree that Chase’s new measures, which are being mimicked by other banks, are centered around preparations for a “bank holiday.” Celente called the new restrictions “unprecedented.”

InfoWars says it appears that Chase is strongly motivated to make it hard for their customers to have any kind of control over their savings and is trying to prevent them from sending dollars abroad, prompting concerns that Cyprus-style account gouging could occur in America.

According to Newswire, the move to limit deposits and withdrawals while banning international wire transfers altogether will cripple many small and medium-sized businesses with Chase accounts. Buying stock from abroad in any kind of quantity will now become impossible for many companies, while paying employees will also be a headache. Grocery stores or restaurants that turnover more than $50k a month will be unable to use their account.

Chase has been under scrutiny since an incident earlier this year when Chase Bank customers across the country attempted to withdraw cash from ATMs only to see that their account balance had been reduced to zero. The problem, which Chase attributed to a technical glitch, lasted for hours before it was fixed, prompting panic from some customers.

Sources: Fox News, InfoWars, NewsWire